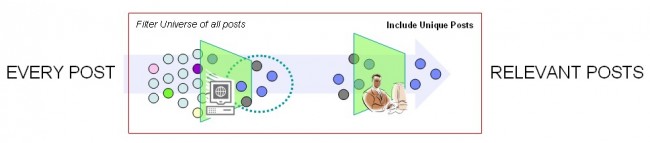

Selecting keywords for your social listening research is the most critical first step to harnessing relevant insights. In a world with a billion computers, four billion cell phones and a robust global Internet, there is an overwhelming amount of digital messages being posted online every day. Since most are likely not relevant to the brand or specific product you’re building a social marketing strategy for, it is important to determine keywords that are contextually aligned to the on-line conversation you’re interested in understanding.

So how do you get started?

Establishing predefined keywords allows you to narrow down the universe of all possible posts to only those that are relevant to the research objectives. Much like developing a screener to determine who you want to invite to a focus group, for example: “Small Business Entrepreneurs” that are “IT professionals” and are the “primary hardware purchase decision-makers” in the “U.S.”

Determine the criteria for inclusion in the listening sample set by defining the keywords that signal: Include this POST in data collection. If the keywords are too broad, then you will get “noise” (irrelevant posts) but if they are too narrow, then you miss relevant conversation and may draw erroneous conclusions.

Keyword Refinement Process

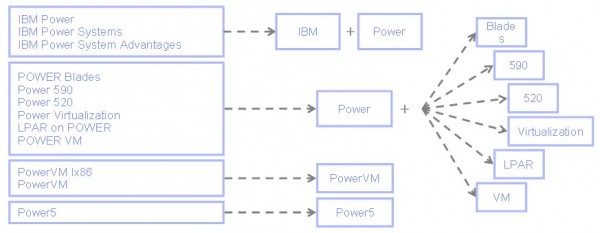

When conducting conversation mining, several “strings” are needed:

– A category string designed to pull in discussion relevant to power-type servers

– A branded string designed to pull in mentions of IBM within the larger discussion of power-type servers

– The category string is shaped into a Boolean keyword string*

– It is primarily composed of the most commonly occurring phrases in the product areas, the idea being that by zeroing in on the terminology that buyers actually use, we will best capture their online conversations

The branded string is primarily based on the IBM branded product names and terms

The original list is re-shaped into a Boolean keyword string*

Here’s an example of a topical hierarchy from a recent project I did for IBM Server & Technology Group, Power Systems brand:

The following recommendations will help you to get started selecting relevant keywords for social listening research:

- Review all of the brand, product specific messaging available to you

- Review messaging of key competitors

- Categorize keywords into a topical hierarchy

- Consider adding a qualifier, such as the Topic name (e.g., Unix, Server)

- Think of what other meanings the words you are using may have in the marketplace (e.g., storage, ensembles, power, service management)

- Be sure to clearly define what you would consider irrelevant, for example: Power Systems related to technology is relevant but Power Systems related to Power Tools or Power/Utility Systems is NOT relevant

- If you are including acronyms, be sure to define and qualify them

- Consider qualifying keywords by proximity mentioned to other relevant keywords, this helps to indicate topical relevance of the dialog

- Validate keywords through Google or other search engines to validate your selection and qualifiers

- Validate keywords through using Twitter search; Think of how Twitter may change words, in terms of abbreviations and slang (e.g., “service” may be “SVC,” “management” may be “mgmt”)

*Note: Boolean Keyword String – A set of keywords that employs Boolean logic to focus and return specific, relevant messages in search